The wait is over! We’re thrilled to present the brand-new GPT Spinner 3.0 addon for WPeMatico — the update that redefines how you automate and transform content from your RSS campaigns. This isn’t just an upgrade… it’s a leap forward, giving you the smartest AI tools at your fingertips with an experience designed to save you time, boost creativity, and multiply results.

What’s fresh and powerful in GPT Spinner 3.0?

What’s fresh and powerful in GPT Spinner 3.0?

More than improvements, this version delivers new superpowers for your content automation strategy. Get ready for more control, customization, and unbeatable flexibility when rewriting your posts.

ChatGPT Integration: Next-level AI, built right in

ChatGPT Integration: Next-level AI, built right in

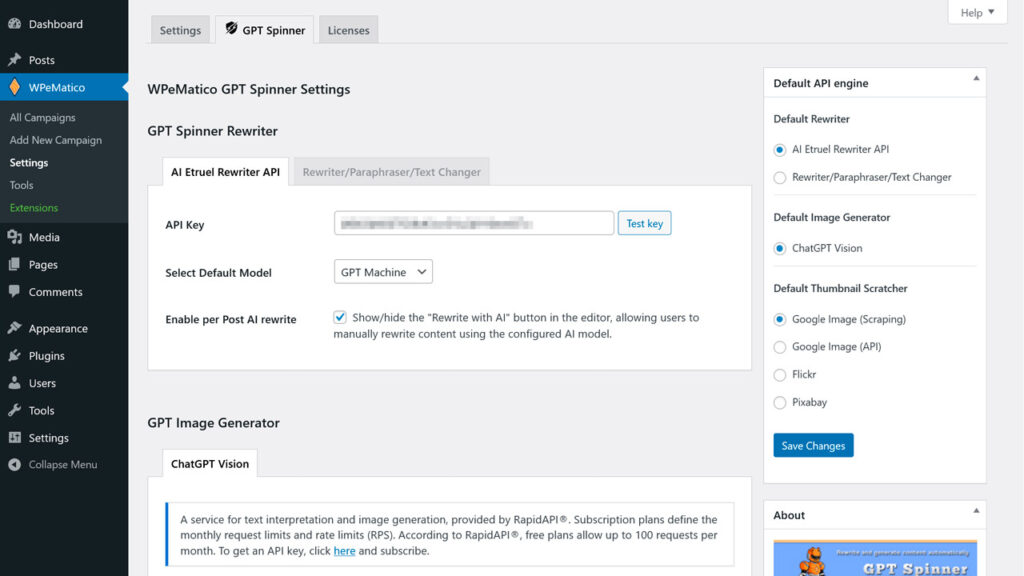

The highlight of this release is the seamless integration with ChatGPT (under the new GPT Machine model). Use your existing AI Etruel Rewriter API Key and unlock the most advanced AI without paying for extra services or external keys. Everything is ready, right inside WPeMatico.

You’re in control:

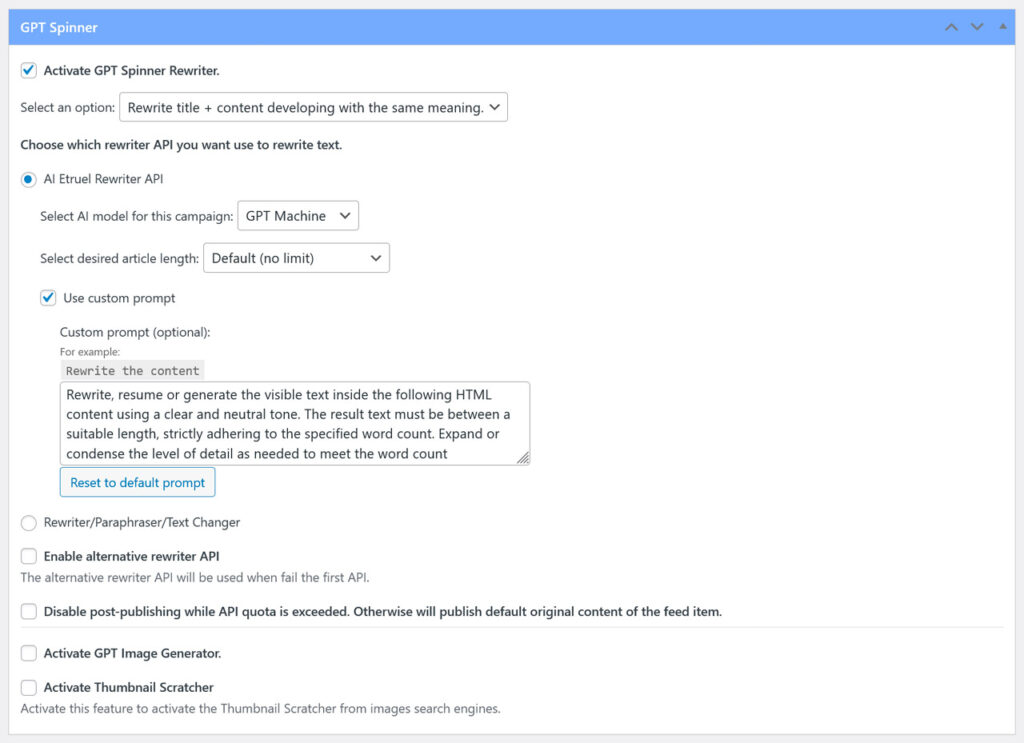

- Switch anytime between Etruel Rewriter and GPT Machine.

- Set your favorite model as default in global settings.

- Choose a different model for each campaign.

No limits. No compromises. Just full flexibility to adapt AI rewriting to your exact goals.

Tailor-made content with custom prompts

Tailor-made content with custom prompts

Want short summaries, detailed articles, or content with a unique style? Now it’s possible!

- Define the length of your rewritten posts (short, medium, or long).

- Customize prompts to shape the tone, voice, and creativity.

The result? Content that feels 100% original, natural, SEO-optimized, and perfectly aligned with your niche.

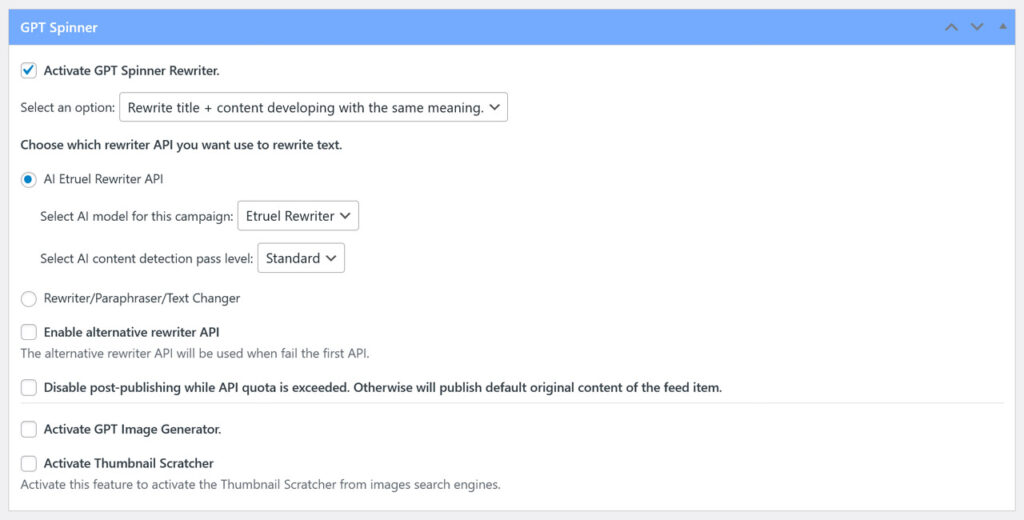

Beat AI detectors with the new “AI Detection Pass Level”

Beat AI detectors with the new “AI Detection Pass Level”

Need content that’s harder to flag by AI-detection tools? The Etruel Rewriter model now includes a brand-new setting: AI Content Detection Pass Level, with 4 modes — Standard, Low, Medium, High. Perfect for stricter platforms and for maximum originality.

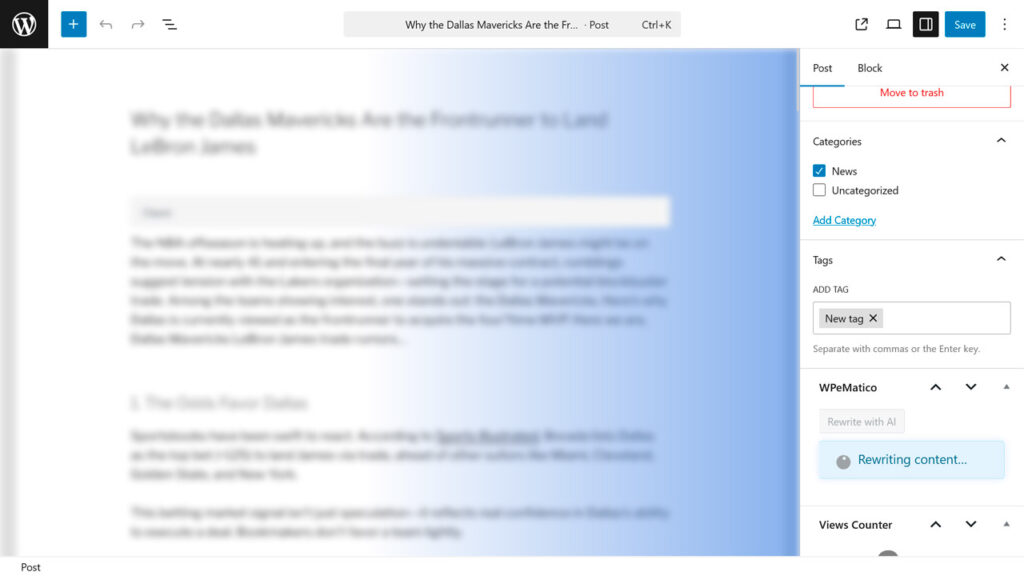

Rewrite any post directly from the editor

Rewrite any post directly from the editor

By popular demand! With the new per Post AI rewrite option, a button appears right inside the WordPress editor. Click it, and instantly rewrite any published or draft post using your selected model — fast, seamless, and without leaving the editor.

Optimized, polished, and better than ever

Optimized, polished, and better than ever

- Performance boosts for smoother operation.

- Fixes that improve content quality.

- Better HTML handling to preserve structure and formatting.

All designed to give you reliable, clean, and high-quality rewritten content.

Who benefits most from GPT Spinner 3.0?

Who benefits most from GPT Spinner 3.0?

- Bloggers who want fresh, unique content from RSS feeds.

- News and niche sites looking to avoid duplicate content.

- SEO agencies managing multiple clients.

- Marketers monetizing with AdSense and needing human-like posts.

Already a user? Update now. New here? Don’t wait!

Already a user? Update now. New here? Don’t wait!

If you already own the addon, update to version 3.0 for free from your client dashboard. If not, this is the perfect moment to start — with the most advanced version ever to elevate your publishing strategy.

Don’t have an API Key yet? Grab your license here:

Compatible, reliable, and always evolving

Compatible, reliable, and always evolving

Backed by years of innovation from etruel, WPeMatico GPT Spinner 3.0 is fully compatible with WordPress and trusted by hundreds of users. This release proves our ongoing commitment: to give you the most advanced AI rewriting experience on the market.

Ready to step up your automated publishing?

Update or get GPT Spinner 3.0 today and revolutionize your content strategy with AI.

Do you already have your own ChatGPT API Key?

Do you already have your own ChatGPT API Key?

For maximum flexibility, we also offer our exclusive Hands-Free Service (only $150/month). With it, you can connect your own OpenAI (ChatGPT) API Key directly into WPeMatico, fully managed by us. No hassle, no setup — just pure power at your disposal.

If you’re interested, simply reach out through our contact form below and we’ll set everything up for you.

Get WPeMatico GPT Spinner 3.0

Get WPeMatico GPT Spinner 3.0 Get AI Etruel Rewriter API

Get AI Etruel Rewriter API

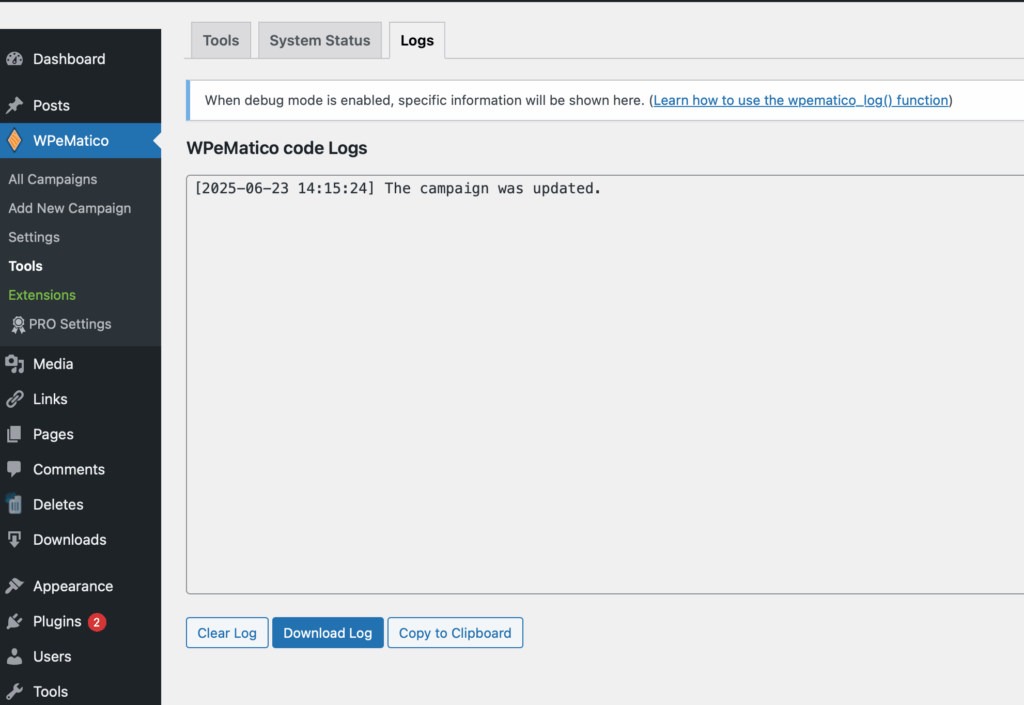

WPeMatico Logs: Your New Debugging Superpower

WPeMatico Logs: Your New Debugging Superpower Developers tweaking custom hooks

Developers tweaking custom hooks Real-World Magic Tricks

Real-World Magic Tricks Check out how clean these logs look:

Check out how clean these logs look:

What’s Down the Road?

What’s Down the Road? Beta invites

Beta invites Get Started Today

Get Started Today